How to Create a Financial Roadmap for Success

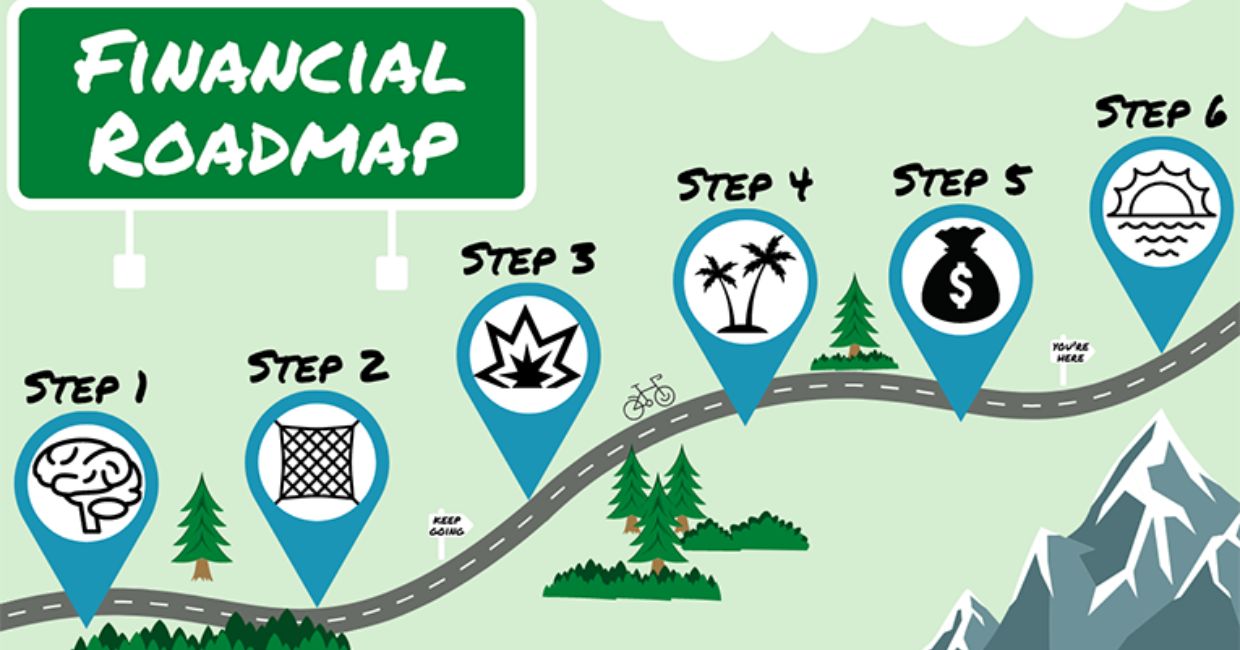

Financial Roadmap

Financial success doesn’t happen by accident. It’s the result of intentional planning, disciplined execution, and consistent action. Just like a traveler needs a map to reach their destination, you need a financial roadmap to navigate your journey toward wealth, freedom, and security.

Whether you’re aiming to get out of debt, buy a home, start a business, or retire early, having a clear financial roadmap helps you move from where you are to where you want to be — with purpose and direction.

In this guide, we’ll break down how to create a financial roadmap for success, step by step. You’ll learn how to define your goals, structure your finances, and build a long-term strategy that ensures your money works for you — not the other way around.

How to Plan for Financial Freedom Before 40

1. Understanding What a Financial Roadmap Is

Before creating one, let’s clarify what a financial roadmap actually means.

A financial roadmap is a structured plan that outlines your financial goals, timelines, and the strategies you’ll use to achieve them. It’s your personal guide to managing money wisely, building assets, and securing your future.

Think of it like GPS for your financial life — it helps you:

- See where you are financially right now.

- Identify where you want to go.

- Plot the best route to reach your destination.

- Adjust when life throws you detours.

A solid financial roadmap gives you clarity, control, and confidence in every financial decision you make.

2. Start by Assessing Your Current Financial Situation

Before you can chart a path forward, you need a clear picture of your current financial reality. Many people skip this step because it can be uncomfortable — but it’s absolutely essential.

Take time to evaluate:

- Income: How much do you earn monthly? Include all sources (salary, side hustles, dividends, etc.).

- Expenses: Track your monthly spending. Separate needs (rent, utilities, food) from wants (entertainment, luxury items).

- Debts: List all your liabilities, including loans, credit cards, and mortgages, along with their interest rates.

- Assets: Note your savings, investments, property, and other valuable possessions.

- Net Worth: Subtract your total liabilities from your total assets.

This financial snapshot is your starting point. Even if your net worth is negative right now, don’t get discouraged — this awareness is the first step toward improvement.

3. Define Your Financial Goals

Once you know where you are, it’s time to decide where you want to go. Setting clear, measurable goals gives your financial roadmap direction.

Divide your goals into three categories:

Short-Term Goals (1–3 years)

These might include:

- Paying off credit card debt.

- Building an emergency fund.

- Saving for a vacation or a new car.

Medium-Term Goals (3–7 years)

These goals could include:

- Buying a house.

- Starting a business.

- Saving for a child’s education.

Long-Term Goals (7+ years)

These are your wealth-building and retirement targets:

- Achieving financial independence.

- Building passive income streams.

- Retiring comfortably.

Make your goals SMART — Specific, Measurable, Achievable, Relevant, and Time-bound. For example:

“Save $20,000 for a house down payment in 3 years”

is clearer than

“Save money for a house.”

4. Build a Realistic Budget

A financial roadmap without a budget is like a car without fuel. A budget helps you control your money instead of letting it control you.

Start with the 50/30/20 rule as a basic guideline:

- 50% of income for needs (housing, food, bills).

- 30% for wants (entertainment, dining out, hobbies).

- 20% for savings, investments, and debt repayment.

If you’re trying to accelerate your wealth-building, adjust the ratios — for example, cut wants to 20% and boost savings to 30%.

Use budgeting tools like Mint, YNAB, or a simple spreadsheet to track your progress. Review your budget monthly to ensure it aligns with your goals.

Remember, a budget isn’t meant to restrict you — it’s a plan for financial freedom.

5. Establish an Emergency Fund

Before you dive into investing or big purchases, protect yourself from financial shocks. Life is unpredictable — medical bills, job loss, or car repairs can derail even the best-laid plans.

An emergency fund acts as your financial cushion.

Aim to save 3–6 months of living expenses in a separate, easily accessible savings account.

This safety net ensures you don’t have to rely on credit cards or loans during tough times. Once your emergency fund is in place, you can confidently move to the next stages of your roadmap.

6. Manage and Eliminate Debt Strategically

Debt can either be your biggest obstacle or a stepping stone — depending on how you handle it.

Start by identifying bad debt (high-interest consumer loans and credit cards) and good debt (mortgages, student loans, or business loans with long-term returns).

To pay off debt efficiently, use one of these methods:

- Debt Snowball: Pay off your smallest debts first to build momentum.

- Debt Avalanche: Focus on paying off the highest-interest debt first to save money.

As you eliminate debt, avoid taking on new unnecessary loans. Becoming debt-free is one of the most liberating steps toward financial success.

7. Build Multiple Income Streams

Relying on one source of income — like a 9-to-5 job — is risky in today’s economy. A key part of your financial roadmap should be income diversification.

Explore ways to build multiple income streams:

- Side Hustles: Freelancing, tutoring, or selling online.

- Investments: Dividend stocks, REITs, or ETFs.

- Passive Income: Creating online courses, eBooks, or rental properties.

- Business Ownership: Starting a small business or partnership.

Each additional income stream adds stability, boosts savings potential, and speeds up wealth accumulation.

8. Start Investing Early — and Consistently

Saving money is essential, but investing is what truly grows wealth. Your roadmap must include a well-thought-out investment plan.

Here’s how to approach it:

- Start small: Even $100 a month invested can grow significantly over time through compounding.

- Diversify: Don’t put all your money in one asset class. Mix stocks, bonds, real estate, and index funds.

- Think long-term: The market fluctuates, but long-term investors benefit from compounding returns.

If you’re new to investing, consider simple options like:

- Index Funds and ETFs: Low-cost, diversified, and beginner-friendly.

- Robo-advisors: Automated investment platforms that manage your portfolio.

- 401(k) or IRA: Retirement accounts with tax advantages.

The key is consistency. Investing regularly — even in small amounts — will grow your wealth over time.

9. Plan for Major Life Events

Your financial roadmap should also account for life milestones — such as marriage, children, education, or retirement. Each stage brings new financial responsibilities and opportunities.

Examples:

- Marriage: Combine finances, plan joint goals, and discuss spending habits.

- Parenthood: Start a college fund and adjust your insurance coverage.

- Retirement: Estimate your expenses and plan your retirement contributions accordingly.

Planning ahead ensures you’re financially prepared for every major event — without stress or last-minute scrambling.

10. Protect Your Financial Future

Building wealth is one thing; protecting it is another. A financial roadmap isn’t complete without risk management.

Here’s how to safeguard your progress:

- Insurance: Health, life, home, and disability insurance protect against unexpected financial shocks.

- Diversification: Spread your investments across different sectors and asset classes to reduce risk.

- Estate Planning: Create a will or trust to ensure your assets are distributed according to your wishes.

Remember: Financial success is fragile without proper protection. One unplanned event can erase years of progress — so plan wisely.

11. Automate Your Finances

One of the simplest yet most effective strategies for staying consistent with your financial roadmap is automation.

You can automate:

- Bill payments to avoid late fees.

- Savings transfers to ensure you pay yourself first.

- Investment contributions through automatic monthly deposits.

Automation removes emotion from financial decisions and builds consistency — the key ingredient for long-term wealth.

12. Monitor Your Progress and Adjust Regularly

A financial roadmap isn’t static — it’s a living document. Life changes, incomes grow, goals shift, and markets evolve. That’s why you should review your plan regularly, at least every 3–6 months.

Ask yourself:

- Are my savings and investments growing as planned?

- Have my expenses increased or decreased?

- Do my goals still align with my current priorities?

Adjust your roadmap based on new circumstances. Staying flexible ensures your plan remains relevant and effective.

13. Prioritize Financial Education

Financial success is directly tied to financial literacy. The more you understand money, the better you can manage and grow it.

Make financial education a lifelong habit:

- Read books like Rich Dad Poor Dad by Robert Kiyosaki or The Millionaire Next Door by Thomas Stanley.

- Follow reputable financial blogs and podcasts.

- Take online courses about investing, budgeting, or real estate.

The more you learn, the fewer mistakes you’ll make — and the faster you’ll reach your financial goals.

14. Surround Yourself with Financially Savvy People

Your environment plays a huge role in your financial mindset. Surround yourself with people who share your values about money, growth, and success.

Network with:

- Entrepreneurs and investors.

- Financial advisors or mentors.

- Like-minded friends who prioritize discipline over instant gratification.

Positive financial influences can motivate you, challenge you, and introduce you to opportunities you might never find alone.

15. Stay Patient and Consistent

This might be the most important part of your financial roadmap: patience.

We live in a world obsessed with instant results — but wealth doesn’t work that way. Building lasting financial success takes years of steady effort, discipline, and smart choices.

Don’t get discouraged if progress feels slow. Remember, compounding — both in money and habits — rewards the consistent.

Stay focused on your goals, and celebrate small wins along the way. Every dollar saved, every debt paid, and every investment made brings you closer to financial freedom.

16. Common Mistakes to Avoid When Creating a Financial Roadmap

Even with the best intentions, many people fall into traps that slow their progress. Avoid these common mistakes:

- Not tracking expenses — ignorance leads to overspending.

- Ignoring debt — it compounds against you just like interest works for you.

- Chasing quick returns — focus on long-term strategies, not trends.

- Neglecting emergency funds — this leads to financial setbacks.

- Failing to review goals — your roadmap must evolve with your life.

Avoiding these mistakes keeps your financial journey smooth and steady.

17. Example of a Simple Financial Roadmap

To help visualize it, here’s an example of what a beginner’s roadmap might look like:

| Time Frame | Goal | Action Plan |

|---|---|---|

| 0–6 months | Build emergency fund | Save $3,000 by cutting discretionary spending |

| 6–12 months | Pay off credit card debt | Use debt avalanche method |

| 1–3 years | Save for home down payment | Automate monthly savings into a separate account |

| 3–5 years | Start investing | Contribute $300/month to index funds |

| 5–10 years | Start a side business | Build online income stream |

| 10+ years | Achieve financial independence | Grow investments and reduce expenses |

This structure gives your financial journey direction and momentum.

18. Final Thoughts: Your Roadmap to Financial Freedom

Creating a financial roadmap for success isn’t about perfection — it’s about progress. It’s about knowing your goals, taking control of your money, and aligning your daily actions with your long-term vision.

When you have a clear roadmap:

- You make smarter decisions.

- You feel more confident about your future.

- You stay motivated, even during setbacks.

Remember: your roadmap is unique to you. No two financial journeys look the same. What matters most is that you start — today.

The earlier you begin planning, the faster you can build wealth, security, and peace of mind.

Financial success isn’t about luck — it’s about direction. And with your own financial roadmap in hand, you’re already halfway there.